Capturing Moments

Your go-to blog for photography tips and inspiration.

Cracking the Code: How On-Chain Transaction Analysis Unravels Blockchain Mysteries

Unlock the secrets of blockchain! Discover how on-chain transaction analysis can reveal hidden insights and unravel complex mysteries.

Understanding On-Chain Analysis: The Key to Unlocking Blockchain Transparency

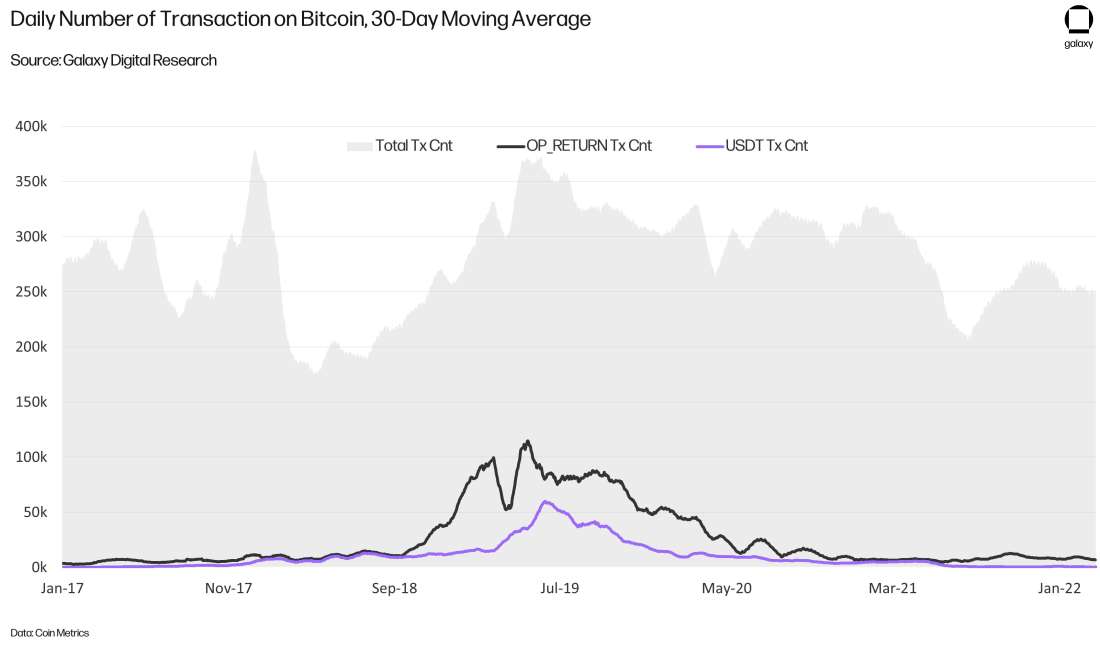

On-chain analysis is a powerful tool that provides unparalleled insights into the blockchain ecosystem. It involves examining the transactions, addresses, and behavior on the blockchain to derive valuable information about market trends, investor behavior, and overall network health. Unlike traditional financial systems where data is often opaque, on-chain analysis leverages the transparency of blockchain technology, allowing anyone to track the movement of assets in real-time. This process not only enhances transparency but also helps in identifying patterns that can guide investment decisions.

By utilizing various analytical techniques, blockchain enthusiasts and investors can gain a clearer understanding of market dynamics. Key components of on-chain analysis include monitoring transaction volumes, assessing wallet activity, and analyzing historical data to evaluate the performance of specific cryptocurrencies. As the cryptocurrency market continues to evolve, the ability to perform effective on-chain analysis will become increasingly important, serving as a necessary tool for anyone looking to navigate the complexities of this digital landscape.

Counter-Strike is a highly popular online first-person shooter game that pits teams of terrorists against counter-terrorists in various objective-based scenarios. Players must work together, strategize, and use their skills with various weapons to secure victory. For a chance to enhance your gaming experience, check out the bc.game promo code that can provide exciting rewards.

How On-Chain Transaction Analysis Can Help Combat Cryptocurrency Fraud

On-chain transaction analysis is an invaluable tool in the fight against cryptocurrency fraud. By examining the detailed records stored on a blockchain, analysts can track the movement of funds across various wallets. Every transaction is recorded transparently, allowing for the identification of suspicious patterns or behavior. For instance, if a wallet is associated with multiple small transactions rapidly executed in a sequence, it may indicate a potential fraudulent scheme. Utilizing advanced analytical tools, experts can create comprehensive flow charts and transaction graphs that lend insight into the origin and destination of funds, enhancing the ability to spot illicit activity.

Moreover, on-chain analysis plays a crucial role in the detection of wash trading and money laundering. By utilizing techniques such as cluster analysis, investigators are able to group addresses related to a single entity, making it easier to identify suspicious networks of transactions. This proactive approach not only aids law enforcement agencies in their investigations but also builds trust in the cryptocurrency ecosystem. As the market grows, the necessity for robust anti-fraud measures becomes even more critical; effective transaction analysis can deter perpetrators by increasing the likelihood of detection and prosecution.

What Can On-Chain Data Tell Us About Market Trends and Investor Behavior?

On-chain data has emerged as a vital resource for analyzing market trends and investor behavior in the cryptocurrency landscape. By leveraging decentralized ledger technology, we can access a wealth of information, including transaction volumes, wallet addresses, and smart contract interactions. This data allows analysts to discern patterns such as accumulation phases, where investors are increasingly buying assets, or distribution phases, where profits are being taken. Market trends can be significantly influenced by factors such as network activity and trading volume, all of which can be gleaned from on-chain metrics.

Furthermore, on-chain data provides insights into investor behavior by illuminating the actions of large holders, commonly referred to as 'whales'. By monitoring their transactions, we can infer potential future movements in the market. For example, if significant transfers occur towards exchange wallets, it may indicate an upcoming sell-off. Additionally, tracking the age of coins can reveal the sentiment around certain assets, as older coins being spent could signal confidence, whereas younger coins might reflect speculative trading. Understanding on-chain data is crucial for anyone looking to navigate the complex world of cryptocurrencies effectively.